Laws, News and Updates, Vapes

Alberta EV Tax Vaping Tax: Everything You Need to Know

In the past few months, Alberta made headlines with the introduction of tax rates aiming at two rapidly growing consumer markets: electric vehicles or EVs and vaping products. If you’re a passionate EV owner/driver or a regular vaper, then you should know about the changes on their respective taxes. This helps you not only for the purpose of budgeting but also for grasping how the province is shifting its approach to transportation infrastructure and public health.Our team at Native Smokes 4 Less breaks down everything you need to know about Alberta’s EV tax and vaping tax. We’ll explain what they are, why they exist, and how they’ll affect you. We’ll also feature key concerns that Canadian consumers like you may have, especially vapers who are already adjusting to the increase in national and provincial taxes on tobacco and nicotine alternatives.

What Is the Alberta EV Tax and Vaping Tax?

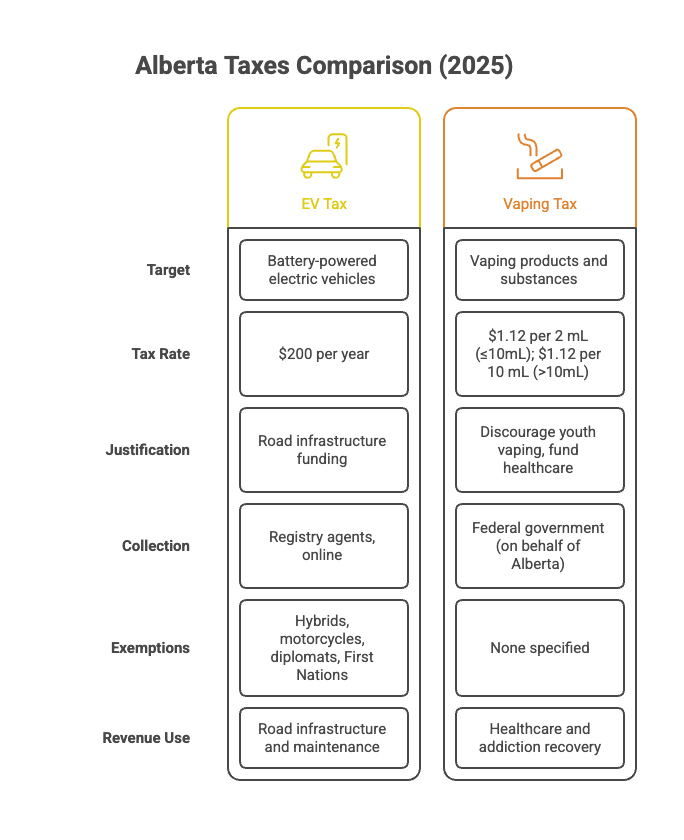

In 2025, Alberta became the first province in Canada to introduce an annual EV tax, which targets solely electric vehicle owners. The tax is set at $200 per year and applies to all fully battery-powered electric vehicles registered in the province.

The reason behind the Alberta EV tax is simple. Electric vehicle owners don’t pay fuel taxes, which are a major funding source for road infrastructure and maintenance. Since more drivers are switching to EVs, the government wants to make sure that all road users will contribute their fair share.

The EV tax of Alberta, however, doesn’t apply to plug-in hybrids or conventional hybrid vehicles, electric motorcycles, and electric off-highway vehicles. It is only applicable to fully battery-electric vehicles. Some individuals or groups are then exempt from the EV tax, including the federal government, diplomats, and First Nations individuals or bands with a registered address on reserve.

Alberta’s electric vehicle tax is slated to be collected by registry agents and online through eService when Albertans register their EVs or renew their vehicle registration. The government of Alberta estimates that the new tax will raise approximately $1 million in its first year of implementation.Aside from the EV tax, Alberta has also introduced a provincial vaping tax that’s aligned with the federal excise duty already in place.As of January 1, 2025, vaping products and vaping substances sold in the province will be subject to a provincial vaping tax. The tax rates will be equivalent to the existing federal tax. So, for vaping products with a volume of 10 mL or less, the tax will be $1.12 per 2 mL or any fraction thereof.

For vaping products with a volume of more than 10 mL, the tax will be $1.12 per 10 mL or any fraction thereof.The additional provincial tax, on top of the federal vaping tax, will significantly increase the cost of e-liquids, pre-filled vape pods, disposable vapes, and other nicotine vaping products. For instance, a 30 mL bottle of vape juice may now include more than $10 in combined taxes, depending on pricing and how retailers pass these costs on to consumers.

The government of Alberta justifies the new vaping tax as a public health measure, intended to discourage the use of vaping products among young people and support smoking cessation initiatives. The collected revenue will then be used to partially fund healthcare and addiction recovery services.

The vaping tax will be collected by the federal government on behalf of Alberta. Afterwards, it will be returned by the federal government to the province.

You can check more details about Alberta’s tobacco tax rates, provincial fuel tax rates, personal income tax rates, and other tax rates in the province on their official webpage.

What Does This Mean to Canadian Vapers?

Vaping products, which you can buy at Native Smokes 4 Less, have become a go-to nicotine product for tobacco users who want to quit smoking cigarettes, cigars, and other similar combustible tobacco products. They even serve as a great alternative to smokeless tobacco like snus and chewing tobacco.But, if you’re a vaper in Alberta, or you want to buy vaping products from Alberta-based retailers, the addition of vaping taxes will definitely hit your wallet. In practical terms, here are some of the potential consequences or effects of the new vaping tax in Alberta.

- Pay more, get less: Vape juices, devices, pods, and disposables will all become more expensive due to the vaping tax in Alberta. Retailers may have to incorporate the new provincial tax in their listed prices. You may even see it added at checkout when shopping online. In total, you can expect to pay around 20 to 30% more for your usual vaping supplies.

- Fewer online shopping options: Out-of-province Canadian vape users who usually buy online from Alberta retailers might be impacted if stores raise prices or reduce their shipping zones due to tax reporting complications and complexities. Some businesses may even forced to shut down or relocate operations just to avoid the additional amount of administrative burdens.

- A chance to quit or switch: If you don’t want to spend too much on vaping products, then it would be the perfect time to cut back, quit altogether, or seek alternative nicotine delivery systems such as nicotine pouches. Alternative nicotine products are currently taxed differently. Hence, you can get them at a much lower price than vaping products. On the flip side, some public health experts worry that the vaping tax will only push a number of vapers back to smoking if alternatives become expensive or inaccessible in the future.

- Unregulated black market sales: The additional vaping tax rates are meant to support Alberta’s public health efforts, which mostly concern the growing number of young people using vaping products. Unfortunately, steep taxes may only result in unregulated black market sales, especially among young users.

The consequences of vaping tax rates in Alberta could have a significant impact on vape users. Therefore, it’s crucial for the government to effectively enforce the new taxation policy and provide users with comprehensive education on the use of vaping products to ensure its success.

Alberta EV Tax Vaping Tax Calculator

The EV tax and vaping tax rates in Alberta are relatively new. So, knowing exactly how much you’ll need to pay may help you budget your money more accurately.

In terms of EV tax calculation, remember that not all types of EVs are included. Hence, if you have plug-in hybrids or conventional hybrid vehicles, electric motorcycles, and electric off-highway vehicles, then you don’t have to worry about calculating any EV tax.

If you own a fully electric vehicle, however, you should pay $200 in tax per year. This applies to full EVs by Tesla, Nissan, and other brands.

As for the vaping tax rates, you have to account for two things: federal excise duty and Alberta provincial tax. The existing federal excise duties are $1 per 2 mL for the first 10 mL and $1 per 10 mL thereafter. Alberta’s provincial tax is then rated similarly to the existing federal excise duties.

Let’s say, a $20 30 mL bottle of vaping product is being sold in Alberta. Based on the rate of $1 per 2 mL (first 10 mL), then $1/10 mL, its federal excise tax would be $7. The additional provincial tax for the same product will be around $7.84 since Alberta’s vaping tax charges $1.12 per 2 mL (first 10 mL), then $1.12/10mL.

In total, the combined excise tax that you have to pay for the said bottle will be $14.84. The final cost of the product would be $34.84, which is 20 to 30% significantly higher than before.

Some retailers may choose to shoulder the additional amount of the vaping product, while others may pass the burden to the customers. Either which, if you will be buying from Alberta, expect the vaping products and accessories to become more expensive.

Frequently Asked Questions

Does Alberta have a vape tax?

Yes. Alberta recently introduced its own provincial vape tax, which has been effective since January 1, 2025. It’s an excise duty based on volume, similar to the federal structure. This vape tax applies to all nicotine-containing vape products sold in the province. They include pods, disposable vaping products, and bottled vape juices or e-liquids.

What is the EV tax in Alberta?

The EV tax in Alberta is a flat $200 per year tax rate that is applied to fully electric vehicles registered in the province. It helps offset lost fuel tax revenue and ensures all drivers will contribute to the road infrastructure and upkeep. Alberta’s EV tax doesn’t apply to hybrids or plug-in hybrid EVs.

Is Alberta adding new taxes on vaping products and electric vehicles to discourage usage?

The new taxes added by Alberta only discourage the usage of vaping products, not electric vehicles. The vaping tax of Alberta has been introduced as a public health tool, making vapes less accessible, especially to youth. The EV tax, alternatively, is only meant to maintain capital gains and ensure fairness in road-use contributions.

Summary

Alberta’s new taxes on electric vehicles and vaping products reflect the evolving priorities in provincial governance. The $200 EV tax aims to maintain coherent transportation funding, while the vaping excise duty intends to reduce youth access and support public health. EV owners, therefore, have to pay a fixed annual fee for their vehicles, while vape users will encounter steep increases in product prices. It somehow pushes consumers to budget more carefully and consider the long-term affordability of their habits.If you will be travelling to other places in Canada and you don’t want to leave your vapes behind, you might be wondering whether they set off metal detectors or not. To know the truth behind this, read this informative blog from Native Smokes 4 Less regarding vapes and metal detectors.