Cigarettes, Guides

How Much Were Cigarettes in the Past?

When people reflect on the cost of cigarettes over the years, it’s often with a sense of disbelief. Prices have changed dramatically—due not just to inflation, but to a complex mix of taxation, regulation, public health initiatives, and shifting consumer demand. For Canadians especially, cigarette prices have followed a very specific trajectory shaped by provincial policies and national health campaigns. In this article, we’ll unpack how much cigarettes used to cost in Canada, decade by decade, while also examining the key influences behind those price shifts.

- Introduction to Cigarette Prices

- Historical Price Trends

- Taxation Impact on Prices

- Factors Influencing Cigarette Prices

- How Much Were Cigarettes in 1970 in Canada?

- How Much Were Cigarettes in 1975 in Canada?

- How Much Were Cigarettes in 1980 in Canada?

- How Much Were Cigarettes in 1990 in Canada?

- How Much Were Cigarettes in 2000 in Canada?

- Frequently Asked Questions

- Summary

Introduction to Cigarette Prices

Cigarette pricing in Canada has never been static. What once cost pennies now takes a real bite out of your wallet. While many assume inflation is solely to blame, the full picture involves a network of contributing factors, federal and provincial taxation being chief among them.Cigarettes were once a staple purchase at corner stores across the country. Throughout the 20th century, they were readily available, widely advertised, and carried none of the packaging restrictions seen today. But as awareness of the health risks grew, so did the push for tighter controls, leading to price increases that reflect more than just rising costs, they represent a shift in public policy and social norms.

Historical Price Trends

Over the last several decades, cigarette prices in Canada have followed a clear upward trajectory, driven by a variety of policy and market forces. While it’s easy to point to inflation as the main reason, the inflation adjusted price of cigarettes tells a deeper story—one shaped by federal cigarette taxes, public health initiatives, and evolving consumer habits.

The average price of a pack in the 1960s and 70s hovered well under a dollar, a figure that seems almost unthinkable today. Back then, there were few barriers to cigarette marketing or consumption. Smoking was common across all age groups, and the adult smoking rate was significantly higher than it is now. Cigarettes were available almost everywhere: gas stations, pharmacies, corner stores. But as the decades progressed, priorities began to shift.

One of the most significant changes came in the form of federal and provincial taxes—and in some cases, additional federal and state taxes (particularly when referencing border trends with the U.S.). These tax increases weren’t random. They were part of a broader strategy aimed at reducing smoking rates and encouraging a smoke free lifestyle, especially among youth. It’s not uncommon for governments to cite raising taxes as one of the most effective public health tools available to reduce cigarette sales.

Another powerful driver of change came through anti smoking media campaigns, especially starting in the late 1980s and early 90s. These campaigns helped reshape public perception of smoking from a cultural norm to a health hazard. Combined with rising prices, they played a key role in driving down the national adult smoking rate and helped solidify policy support for ongoing taxation.

Even from a market standpoint, the average weighted retail price of cigarettes reflects more than just the cost of tobacco itself. It includes packaging regulations, retailer margins, transportation, and compliance with health warning legislation. As these factors became more complex, so too did pricing. Looking at the inflation adjusted price, it’s clear that cigarette affordability has steadily declined—deliberately so.

It’s also worth mentioning that despite these pricing strategies, cigarette sales haven’t disappeared. Many long-time smokers have simply adjusted their purchasing habits. Some switched to alternative nicotine sources like nicotine pouches or vapes, while others found more affordable supply chains—such as Indigenous-run outlets like NativeSmokes4Less, where legal, lower-cost options are available without the markup caused by multiple layers of taxation.

In short, the question of what cigarettes cost in the past opens the door to a broader conversation about regulation, public health, and market response. The result? A pricing environment that reflects not just dollars and cents, but decades of social and political momentum.

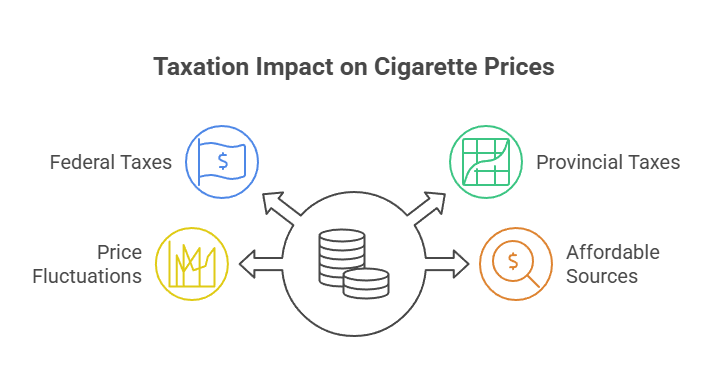

Taxation Impact on Prices

Arguably the biggest driver of cigarette price increases in Canada has been taxation. Federal and provincial governments have both levied significant excise duties on tobacco products as part of their public health mandates.

- Federal Taxes: These apply country-wide and are set annually. Over time, the federal government has increased its tobacco excise tax rates multiple times to keep up with inflation and discourage consumption.

- Provincial Taxes: Each province adds its own layer of taxation, which leads to noticeable price variation across Canada. For instance, a pack in Ontario might be a few dollars cheaper than one in British Columbia.

This layered tax approach explains why cigarette prices have never remained static for long. It’s also one of the primary reasons people seek out more affordable sources

Factors Influencing Cigarette Prices

The cost of cigarettes has never been dictated by production costs alone. In Canada, a range of external factors have steadily influenced the retail price of cigarettes over the years. While per pack pricing might seem straightforward at first glance, the forces behind it are layered and complex.

1. Government Taxation and Regulation

One of the most consistent drivers behind price increases has been taxation. Both federal and provincial tax administrators have played active roles in shaping tobacco pricing through layered excise duties. These taxes aren’t just fiscal tools—they’re policy levers. In many cases, governments employed tax hikes specifically to reduce annual consumption, especially among younger demographics.In fact, raising the per pack price is widely regarded as one of the most effective deterrents to smoking. Research cited in various tobacco reports supports this, showing that for every meaningful increase in price, smoking rates tend to decline—particularly among first-time or casual smokers.

2. Public Health Strategies and Education

Another major factor shaping cigarette costs stems from health-oriented policy. As the link between smoking and disease became undeniable, Canadian health agencies ramped up efforts to reduce preventable death associated with tobacco use. According to multiple reports, lung cancer, bronchus cancer deaths, and broader cancer deaths connected to smoking remain among the most critical public health concerns in Canada.With smoking still responsible for millions of deaths globally each year, Canadian policymakers leaned into both legislation and health education to discourage use. These strategies include strict warning labels, plain packaging laws, and educational outreach that reinforces the risks. These programs—along with compliance regulations for the tobacco industry—add indirect costs to cigarette production and retailing, which ultimately raise the retail price.

3. Legal Compliance and Distribution Costs

Modern tobacco manufacturing is tightly regulated. Today’s cigarette packaging must comply with extensive legal requirements, including bilingual warnings, graphic imagery, and brand restrictions. Each of these regulations increases operational complexity and cost—an expense that gets passed on in the per pack price.Additionally, distribution costs play a role. From wholesaler to retailer, every step of the supply chain affects the final retail price seen by consumers. Remote communities may face higher per pack costs due to transportation, while urban areas often see more competitive pricing thanks to volume sales.

4. Consumption Trends and Demand

While demand has declined overall, especially with rising awareness of smoking’s health risks, annual consumption remains significant among certain demographics. Fluctuations in consumer behaviour—whether tied to income, health concerns, or access to alternatives—also impact pricing. For example, when cigarette sales drop sharply, manufacturers may increase prices to maintain profit margins.Meanwhile, the government’s dual focus on discouraging use and collecting tobacco-related revenue keeps per pack costs relatively high. This balance between health and economics is often noted in official tobacco reports, which analyze everything from consumption patterns to public spending on related health care.

How Much Were Cigarettes in 1970 in Canada?

In 1970, a pack of 20 cigarettes in Canada typically cost around $0.40 to $0.70, depending on the brand and region. Keep in mind, that would be closer to $3 to $5 in today’s money when adjusted for inflation.At the time, there were minimal restrictions on advertising, and tobacco was heavily normalized in daily life. Many people bought cigarettes by the carton, often at discount retailers or local grocery stores. Taxation was relatively low, making cigarettes an accessible habit for nearly all demographics.

How Much Were Cigarettes in 1975 in Canada?

By 1975, prices had edged up slightly, reaching approximately $0.75 to $0.90 per pack. This was due in part to early efforts by health authorities to begin discouraging smoking.Packaging started to include health warnings, though still mild by today’s standards. Cigarette advertising remained widespread, but there was a noticeable shift in tone. This was the beginning of a long-term price escalation driven by the intersection of public policy and public health.

How Much Were Cigarettes in 1980 in Canada?

Fast forward to 1980, and Canadian smokers were paying about $1.25 to $1.50 per pack. While still affordable by modern standards, the increase reflected a growing national conversation about smoking-related diseases.Governments started adding modest sin taxes, and anti-smoking campaigns gained momentum. While many smokers didn’t immediately change their habits, the higher prices began shaping future consumer behaviours—especially among younger Canadians.

How Much Were Cigarettes in 1990 in Canada?

In 1990, the price for a pack like Canadian Rollies cigarettes raised by a certain percentage. This was a period of aggressive tax hikes across several provinces, particularly Ontario and Quebec.This decade also marked the rise of underground markets and increased interest in low-cost alternatives. More Canadians began to explore tax-free sources and First Nations-run tobacco outlets as viable options. The price jump made affordability a top concern for frequent smokers.

How Much Were Cigarettes in 2000 in Canada?

By the year 2000, the average cost of a pack in Canada had reached $5 to $7, with some regions even higher. This pricing put Canada among the top tier globally for cigarette costs at the time.Tobacco control laws became more sophisticated. Graphic health warnings, advertising bans, and indoor smoking prohibitions were now the norm. Combined with rising taxes, this helped reshape how Canadians purchased cigarettes, leading many to look for budget-friendly, legal alternatives.

Frequently Asked Questions

How much were cigarettes in 2007 in Canada?

The cost varied by province due to differences in federal and provincial taxes. Some regions like Newfoundland and British Columbia had higher rates, while others like Quebec were slightly more affordable.

Was there ever 25 cigarettes in a pack?

For many years in Canada, cigarette packs commonly came in 25s, in addition to the standard 20s. The 25-pack format was popular among regular smokers because it offered a bit more value per cigarette.

What were cigarettes like in the 1800s?

Cigarettes in the 1800s were a far cry from the mass-produced, tightly regulated products we see today. Back then, smoking was often a DIY activity, people hand-rolled tobacco using loose leaves and homemade papers.

Summary

Understanding how cigarette prices have changed over time in Canada helps explain why so many smokers today are looking for smarter ways to buy. It’s not just about cost, it’s about access, fairness, and having options.That’s exactly where NativeSmokes4Less comes in. If you’re looking for Canadian Classics cigarettes, we provide Canadian adults with trusted, affordable tobacco products—without the extra costs stacked on by inflated provincial taxes. We respect your right to choose while keeping the experience smooth and reliable.